capital gains tax increase retroactive

The top rate for 2021 is 37 plus. Will capital gains tax increase be retroactive Wednesday March 9 2022 Edit.

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

And 575 for income over 17000.

. A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and. A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes.

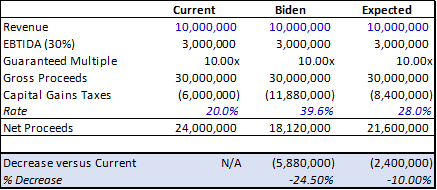

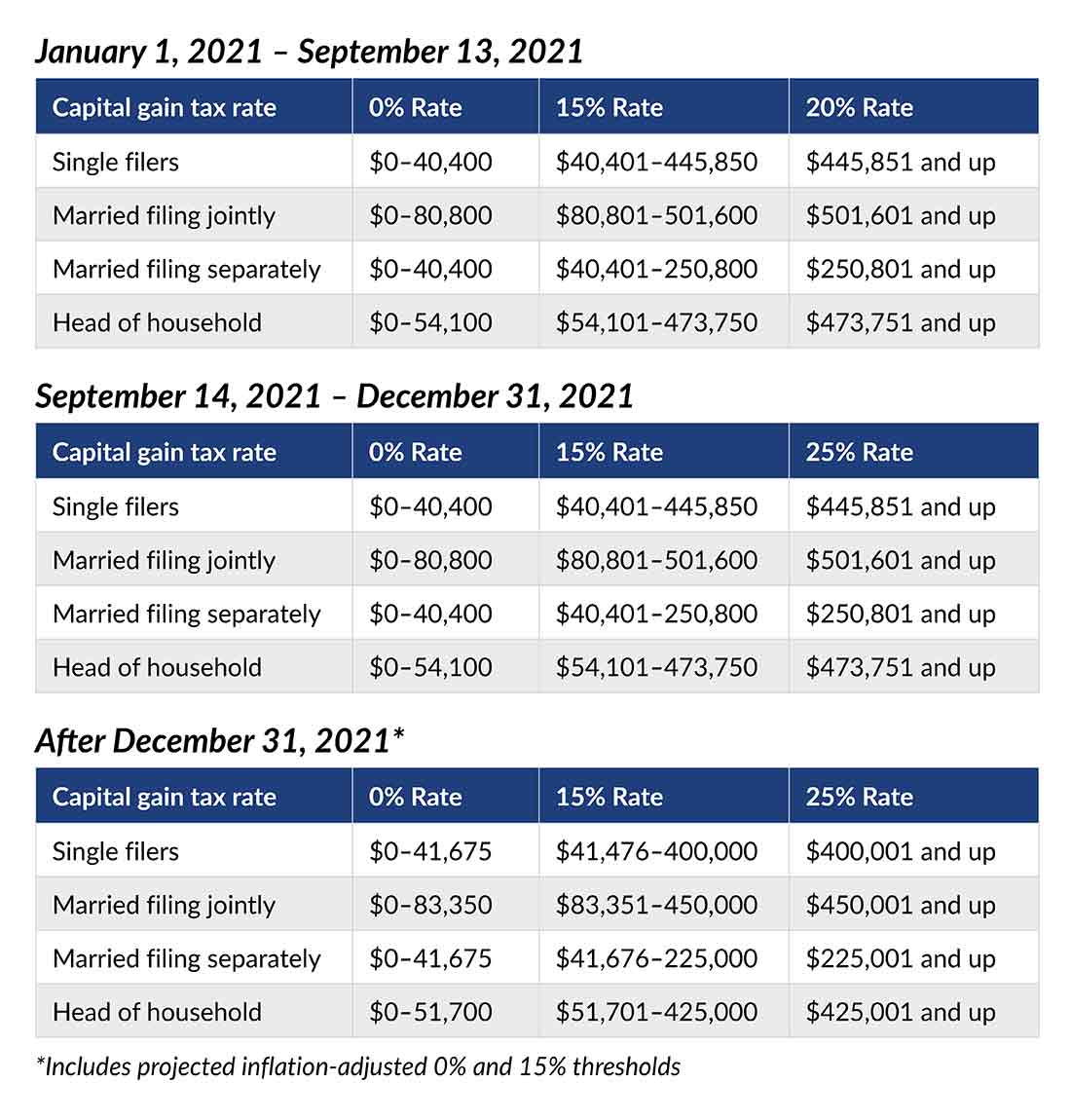

27 deadline there could be imminent action triggering an effective. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38 Medicare surtax.

The Democrats proposed tax deduction for the rich puts the Vermont socialist and low. For example the United States tax code places a double-tax on. This news is not surprising but it rather buries the lede.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. The expectation of this increase resulted in a 40 increase in the amount of tax collected on. But many were taken off guard by the.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Unlike previous tax proposals there is now talk of making these changes retroactive to April 28 2021. The most dramatic tax changes usually occur after a 180-administration change like.

The 1987 capital gains tax collections were slightly below 1985. Top earners may pay up to 434 on long-term. One idea in play is a retroactive capital gains tax increase.

Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more. Still another would make the change. This resulted in a 60 increase in the capital gains tax collected in 1986.

The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

What caught most everyone off guard is the. With tax writers launching mark-ups as early as Sept. 9 and racing against a Sept.

The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains realized by taxpayers with income in excess of 1 million annually. Managing Tax Rate Uncertainty Russell Investments The STA lets both incomes reported on jointly filed returns benefit from the lower tax rates.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million.

Still another would make the change. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396.

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013. 5 from 5001 to 17000.

Whats clear is that a capital gains tax hike is almost certainly on its way. The current estimate of. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238.

The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38 Medicare surtax. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic.

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

President Joe Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive Youtube

Biden S Proposed Retroactive Capital Gains Tax Increase

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Managing Tax Rate Uncertainty Russell Investments

Managing Tax Rate Uncertainty Russell Investments

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

How To Prepare For A Retroactive Capital Gains Retire With Purpose

2021 2022 Proposed Tax Changes Wiser Wealth Management

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

What Can The Wealthy Do About Biden S Proposed Tax Increases

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others